Uniqlo Heattech Size Chart

Uniqlo Heattech Size Chart - Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. Here are 20 different capital efficient expanded canvas portfolios with 4+ strategies by return stacking alternatives with stocks and bonds. I've picked sofi with a 3.50% apy at. Compare hybb and hys across key investment metrics, including historical performance, risk, expense ratio, dividends, sharpe ratio, and more, to determine which asset. Goal is to reach 2.5k /month by next august,” the investor said. As expected, most of the holdings in. The amount you should save may depend on the goals you have for your money, such as an emergency fund, dream vacation or a down payment on a home. So they can work well as an emergency fund or cash holding or even as more bonds for retirement (allowing one to potentially hold more stocks elsewhere). Currently have ~$200k in cash sitting in a checking account getting 0.001% apy. 401k, traditional or roth ira, hsa, etc. 401k, traditional or roth ira, hsa, etc. “i created a hyper dividend portfolio last month and collected 1k last month. You can have a max of 4 accounts. Typical advice is that you don’t need more than max 6 months in an emergency fund. Currently have ~$200k in cash sitting in a checking account getting 0.001% apy. So they can work well as an emergency fund or cash holding or even as more bonds for retirement (allowing one to potentially hold more stocks elsewhere). Unless you are saving for something like a house. Compare hybb and hys across key investment metrics, including historical performance, risk, expense ratio, dividends, sharpe ratio, and more, to determine which asset. Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. I hope you’re not neglecting. I hope you’re not neglecting. Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. I've picked sofi with a 3.50% apy at. Currently have ~$200k in cash sitting in a checking account getting 0.001% apy. I've been advised by friends&fam to move it to an. Currently have ~$200k in cash sitting in a checking account getting 0.001% apy. Here are 20 different capital efficient expanded canvas portfolios with 4+ strategies by return stacking alternatives with stocks and bonds. “i created a hyper dividend portfolio last month and collected 1k last month. (you can have 1 * $10k, 1* $20k, and 2* $5k accounts all adding. I hope you’re not neglecting. “i created a hyper dividend portfolio last month and collected 1k last month. Typical advice is that you don’t need more than max 6 months in an emergency fund. So they can work well as an emergency fund or cash holding or even as more bonds for retirement (allowing one to potentially hold more stocks. Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. (you can have 1 * $10k, 1* $20k, and 2* $5k accounts all adding to the max starting capital of $40k). I've been advised by friends&fam to move it to an hysa. Goal is to reach. You can have a max of 4 accounts. (you can have 1 * $10k, 1* $20k, and 2* $5k accounts all adding to the max starting capital of $40k). Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. The amount you should save may depend. Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. Unless you are saving for something like a house. Here are 20 different capital efficient expanded canvas portfolios with 4+ strategies by return stacking alternatives with stocks and bonds. You can have a max of 4. Here are 20 different capital efficient expanded canvas portfolios with 4+ strategies by return stacking alternatives with stocks and bonds. Compare hybb and hys across key investment metrics, including historical performance, risk, expense ratio, dividends, sharpe ratio, and more, to determine which asset. Hys launched on jun 15, 2011 and has a 0.56% expense. (you can have 1 * $10k,. I've been advised by friends&fam to move it to an hysa. I've picked sofi with a 3.50% apy at. Typical advice is that you don’t need more than max 6 months in an emergency fund. Currently have ~$200k in cash sitting in a checking account getting 0.001% apy. Generally speaking, if you have an emergency fund you are comfortable with. Typical advice is that you don’t need more than max 6 months in an emergency fund. Hys launched on jun 15, 2011 and has a 0.56% expense. Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. Goal is to reach 2.5k /month by next august,”. Goal is to reach 2.5k /month by next august,” the investor said. Compare hybb and hys across key investment metrics, including historical performance, risk, expense ratio, dividends, sharpe ratio, and more, to determine which asset. As expected, most of the holdings in. Hys launched on jun 15, 2011 and has a 0.56% expense. Generally speaking, if you have an emergency. The amount you should save may depend on the goals you have for your money, such as an emergency fund, dream vacation or a down payment on a home. (you can have 1 * $10k, 1* $20k, and 2* $5k accounts all adding to the max starting capital of $40k). Currently have ~$200k in cash sitting in a checking account getting 0.001% apy. You can have a max of 4 accounts. Generally speaking, if you have an emergency fund you are comfortable with it’s best to max out investments in all tax advantaged accounts next. Here are 20 different capital efficient expanded canvas portfolios with 4+ strategies by return stacking alternatives with stocks and bonds. I hope you’re not neglecting. Compare hybb and hys across key investment metrics, including historical performance, risk, expense ratio, dividends, sharpe ratio, and more, to determine which asset. Hys launched on jun 15, 2011 and has a 0.56% expense. Goal is to reach 2.5k /month by next august,” the investor said. 401k, traditional or roth ira, hsa, etc. So they can work well as an emergency fund or cash holding or even as more bonds for retirement (allowing one to potentially hold more stocks elsewhere). I've picked sofi with a 3.50% apy at. Unless you are saving for something like a house.UNIQLO SIZE CHART

Uniqlo men’s HEATTECH thermal pants/OK for women! Uniqlo men, Thermal pants, Heattech

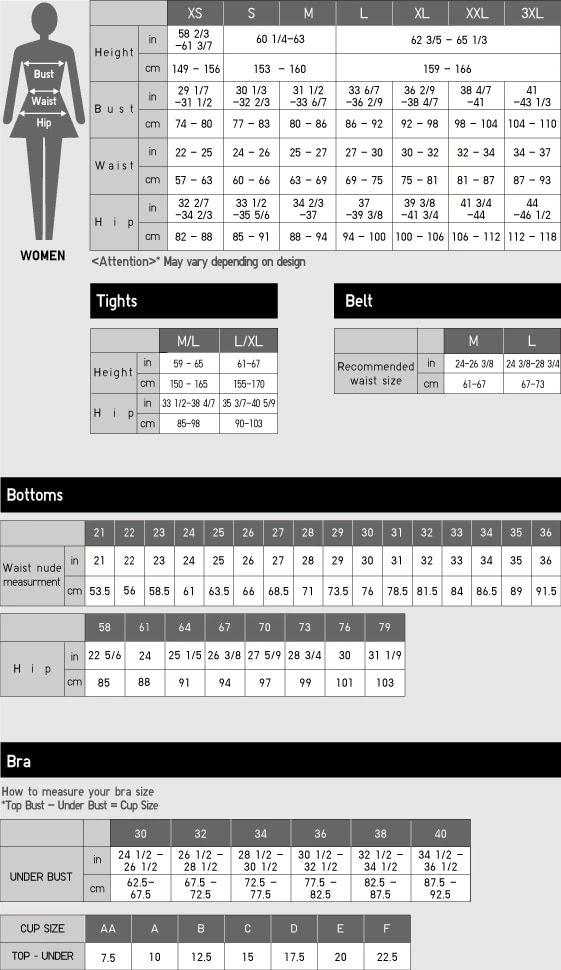

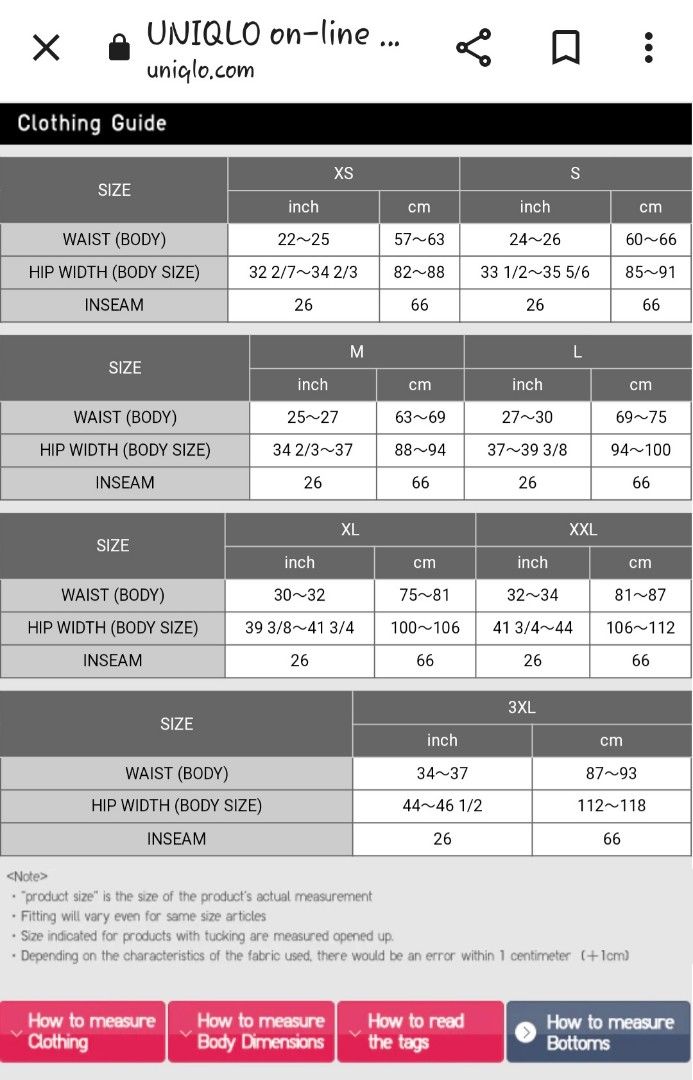

UNIQLO SIZE CHART

Men Heattech UNIQLO US

UNIQLO

Uniqlo HEATTECH The Secret Tech to Brave Winter Prabhu Ram

UNIQLO

Heattech for Adult(Uniqlo)bottom only, Women's Fashion, Bottoms, Other Bottoms on Carousell

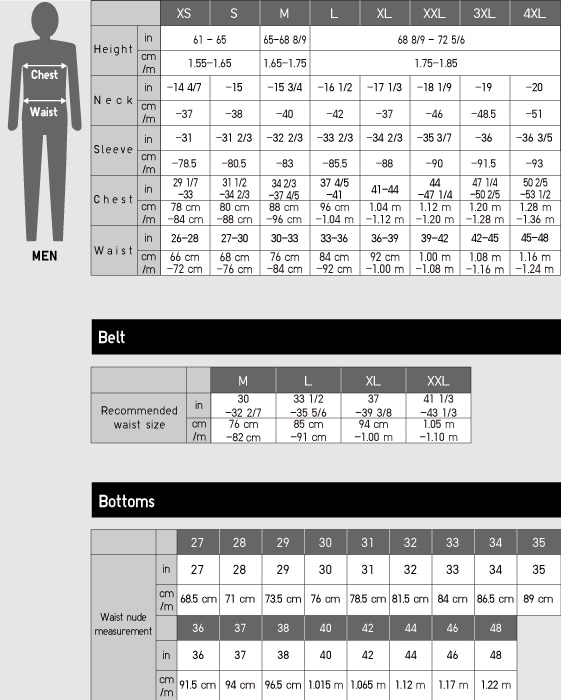

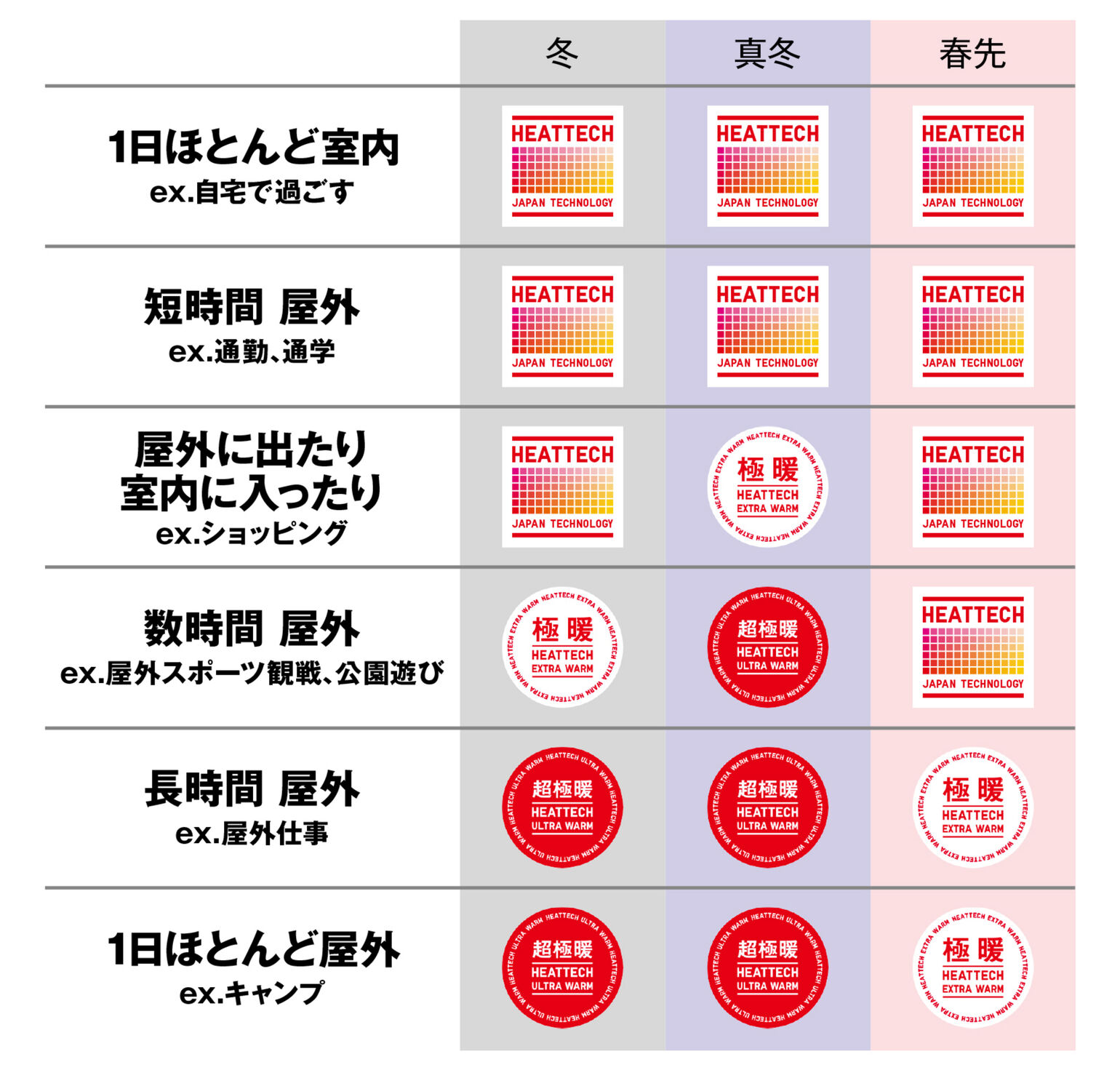

Uniqlo Heattech Temperature Guide atelieryuwa.ciao.jp

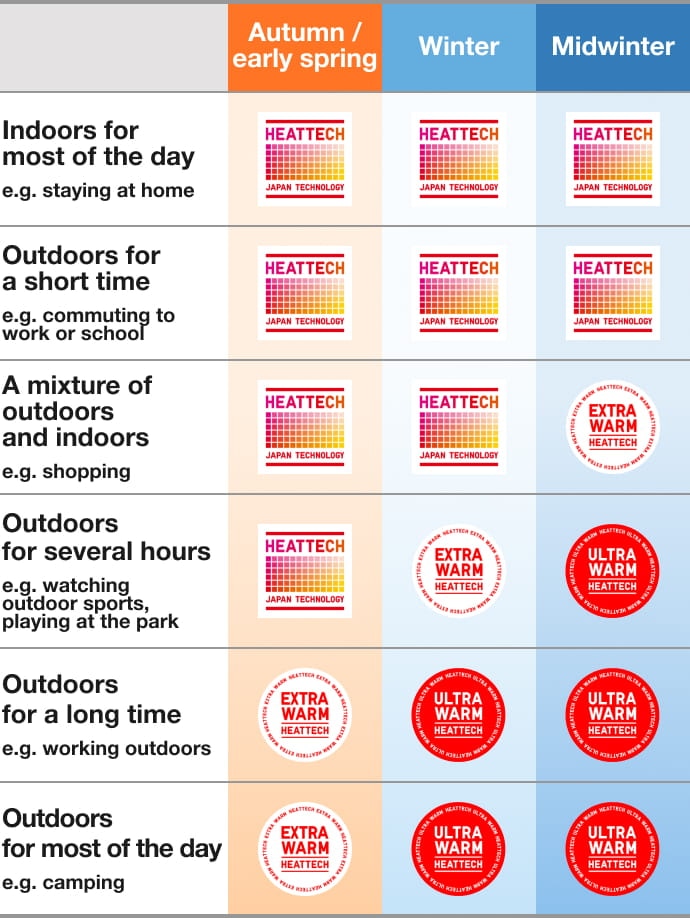

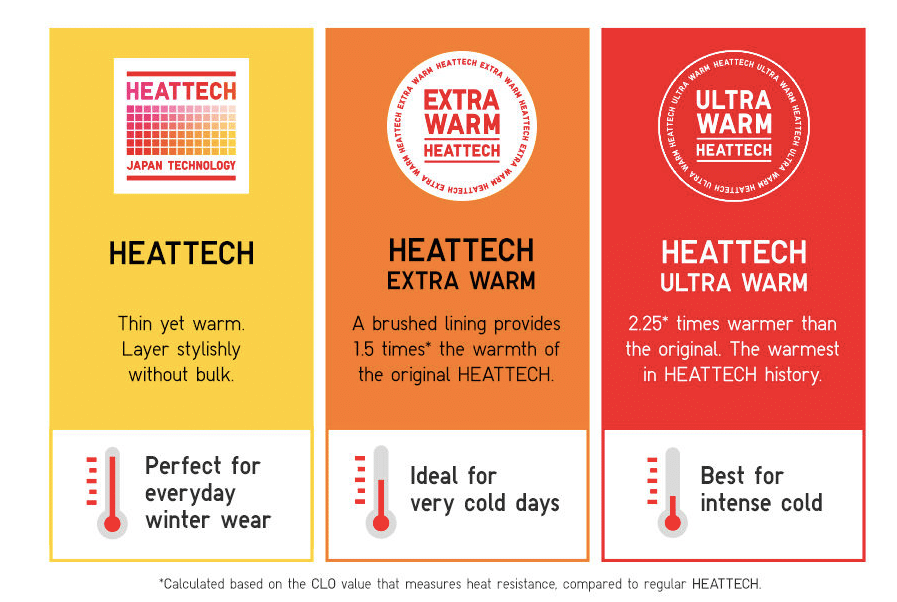

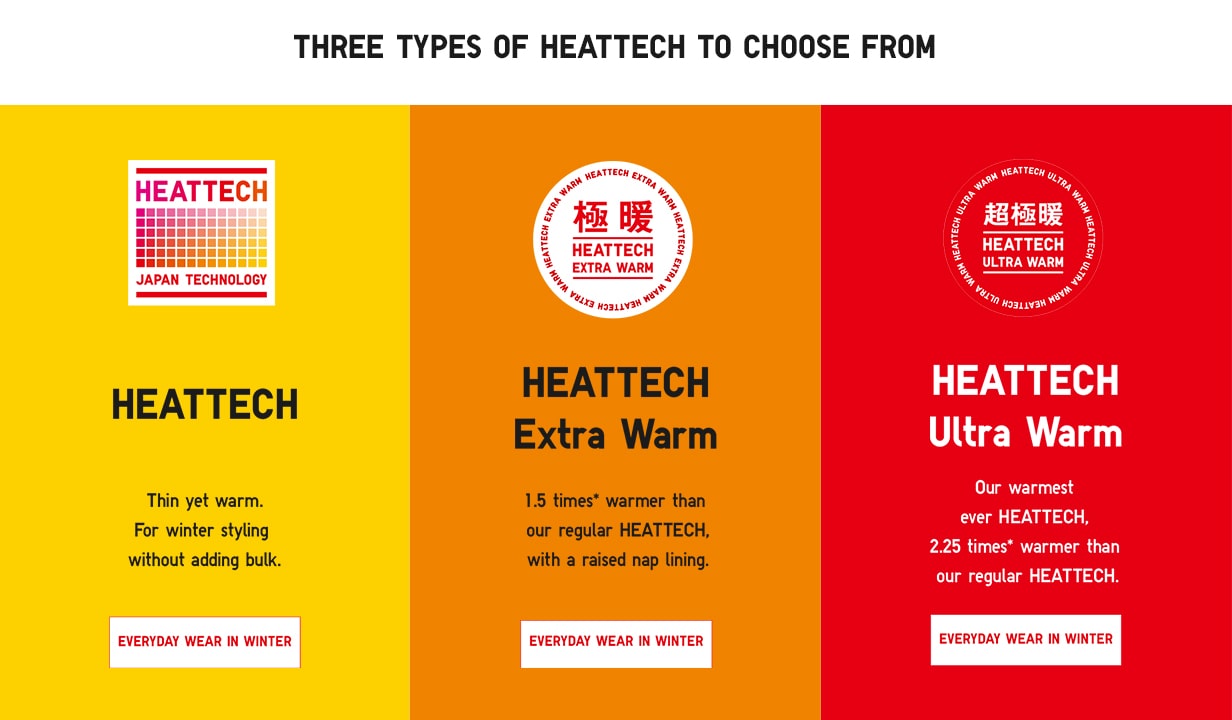

HEATTECH Offers More than Just Warmth! Choose the Right Model to Get that Extra! TODAY'S PICK

I've Been Advised By Friends&Fam To Move It To An Hysa.

As Expected, Most Of The Holdings In.

Typical Advice Is That You Don’t Need More Than Max 6 Months In An Emergency Fund.

“I Created A Hyper Dividend Portfolio Last Month And Collected 1K Last Month.

Related Post: