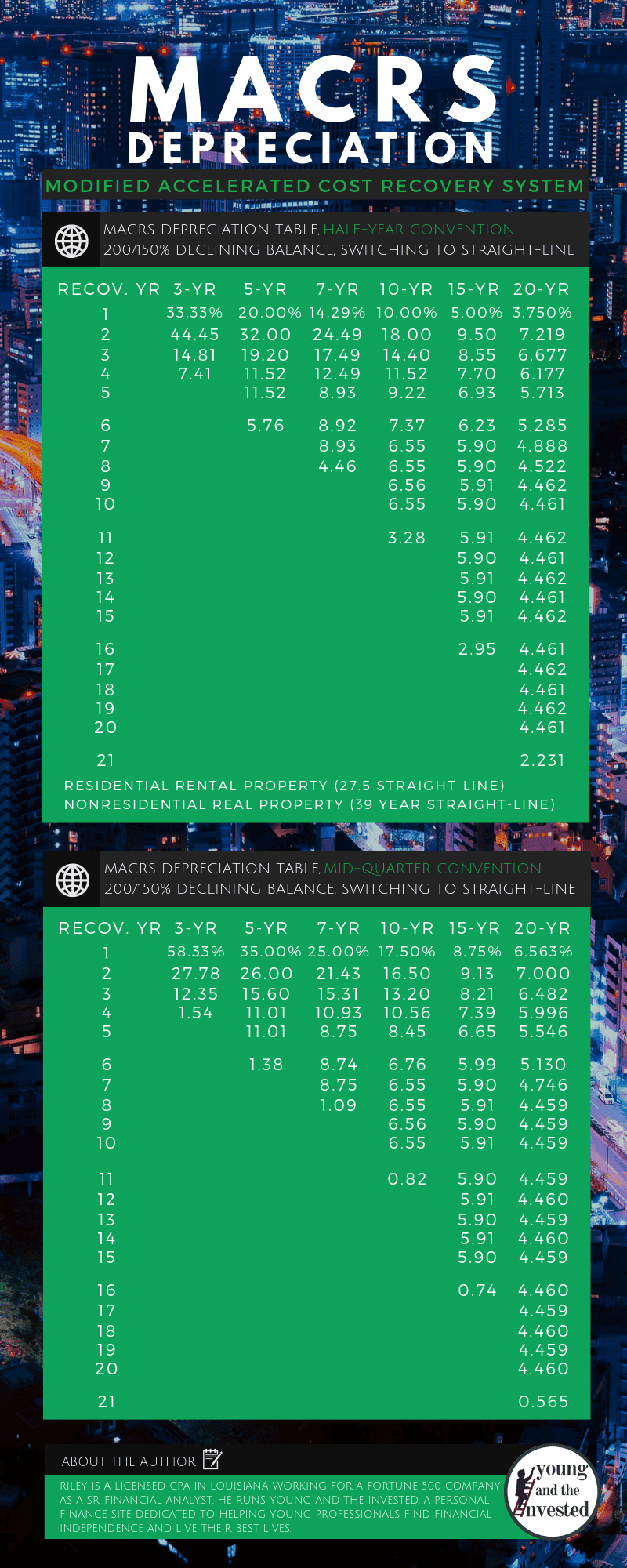

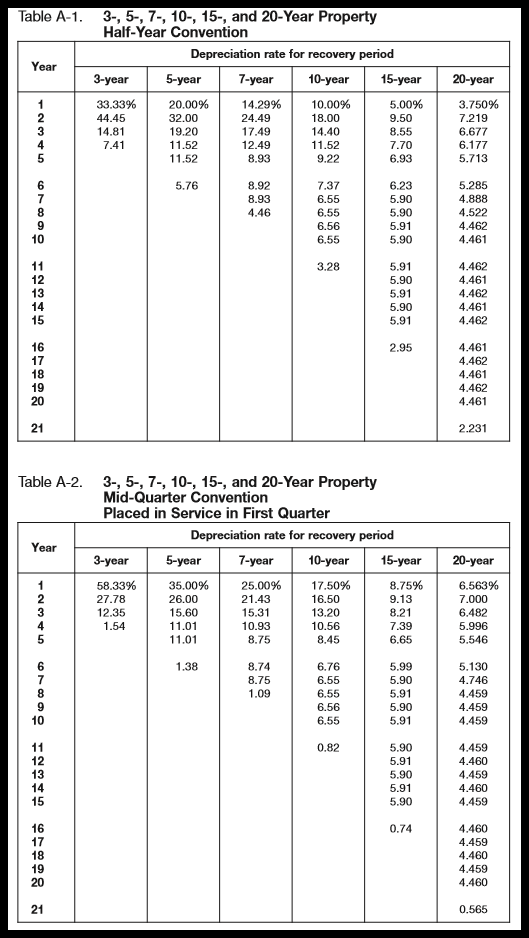

Macrs Depreciation Chart

Macrs Depreciation Chart - With macrs, the accelerated depreciation schedule results in higher deductions in the early years, which means the tax benefits are realized sooner. The modified accelerated cost recovery system (macrs) uses specific conventions to determine when depreciation begins and ends. Generally, these systems provide different methods. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). Macrs (the full form is modified accelerated cost recovery system) is a depreciation method used in the united states for tax purposes. Macrs stands for modified accelerated cost recovery system. Macrs allows for greater accelerated depreciation over. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. It is the tax depreciation system used in the united states to calculate asset depreciation. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. Macrs allows for greater accelerated depreciation over. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. This means that the business can take larger tax deductions in the initial years and. The modified accelerated cost recovery system (macrs) was established under the tax reform act of 1986 to refine acrs while maintaining accelerated depreciation benefits. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. This comprehensive guide explores the macrs. Under this system, the capitalized cost (basis) of tangible property is. The modified accelerated cost recovery system (macrs) uses specific conventions to determine when depreciation begins and ends. This comprehensive guide explores the macrs. The modified accelerated cost recovery system (macrs) uses specific conventions to determine when depreciation begins and ends. Generally, these systems provide different methods. The modified accelerated cost recovery system (macrs) was established under the tax reform act of 1986 to refine acrs while maintaining accelerated depreciation benefits. Macrs allows for greater accelerated depreciation over. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). Under this system, the capitalized cost (basis) of tangible property is. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Macrs stands for modified accelerated cost recovery system. The modified accelerated cost recovery system (macrs) uses specific conventions. This comprehensive guide explores the macrs. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. With macrs, the accelerated depreciation schedule results in higher deductions. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. Macrs stands for modified accelerated cost recovery system. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Generally, these systems provide different methods. It allows for a higher depreciation deduction in the. This means that the business can take larger tax deductions in the initial years and. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. Macrs stands for modified accelerated cost recovery system. Macrs allows for greater accelerated depreciation over. Macrs (the full form is modified accelerated cost recovery system) is a depreciation method used. It allows for a higher depreciation deduction in the. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. Macrs stands for modified accelerated cost recovery system. It is the tax depreciation system used in the united states to calculate asset depreciation. This means that the business can take larger tax deductions in the initial. The modified accelerated cost recovery system (macrs) uses specific conventions to determine when depreciation begins and ends. Under this system, the capitalized cost (basis) of tangible property is. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. The modified accelerated cost recovery system (macrs) was established under the tax reform act of 1986 to. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. With macrs, the accelerated depreciation schedule results in higher deductions in the early years, which means the tax benefits are realized sooner. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. The modified accelerated cost recovery system (macrs). The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. It allows for a higher depreciation deduction in the. It is the tax depreciation system used in the united states to calculate asset depreciation. Macrs stands for modified accelerated cost recovery system. Macrs consists of two depreciation systems, the general depreciation system (gds) and the. The modified accelerated cost recovery system (macrs) is the current tax depreciation system in the united states. Under this system, the capitalized cost (basis) of tangible property is. The macrs depreciation method allows greater accelerated depreciation over the life of the asset. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. With macrs, the. Macrs stands for modified accelerated cost recovery system. Generally, these systems provide different methods. This comprehensive guide explores the macrs. It is the tax depreciation system used in the united states to calculate asset depreciation. Understanding the modified accelerated cost recovery system (macrs) is crucial for businesses managing asset depreciation. Macrs allows for greater accelerated depreciation over. The modified accelerated cost recovery system (macrs) is the proper depreciation method for most assets. The modified accelerated cost recovery system (macrs) uses specific conventions to determine when depreciation begins and ends. Macrs (the full form is modified accelerated cost recovery system) is a depreciation method used in the united states for tax purposes. The modified accelerated cost recovery system (macrs) was established under the tax reform act of 1986 to refine acrs while maintaining accelerated depreciation benefits. Macrs consists of two depreciation systems, the general depreciation system (gds) and the alternative depreciation system (ads). With macrs, the accelerated depreciation schedule results in higher deductions in the early years, which means the tax benefits are realized sooner. Under this system, the capitalized cost (basis) of tangible property is.MACRS Depreciation, Table & Calculator The Complete Guide

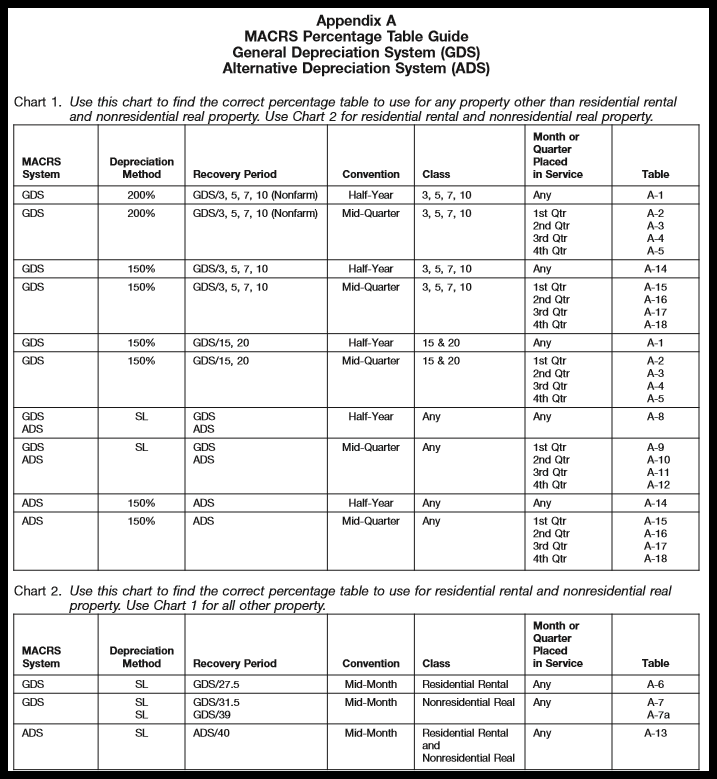

MACRS Depreciation Tables & How to Calculate

MACRS Depreciation Tables & How to Calculate

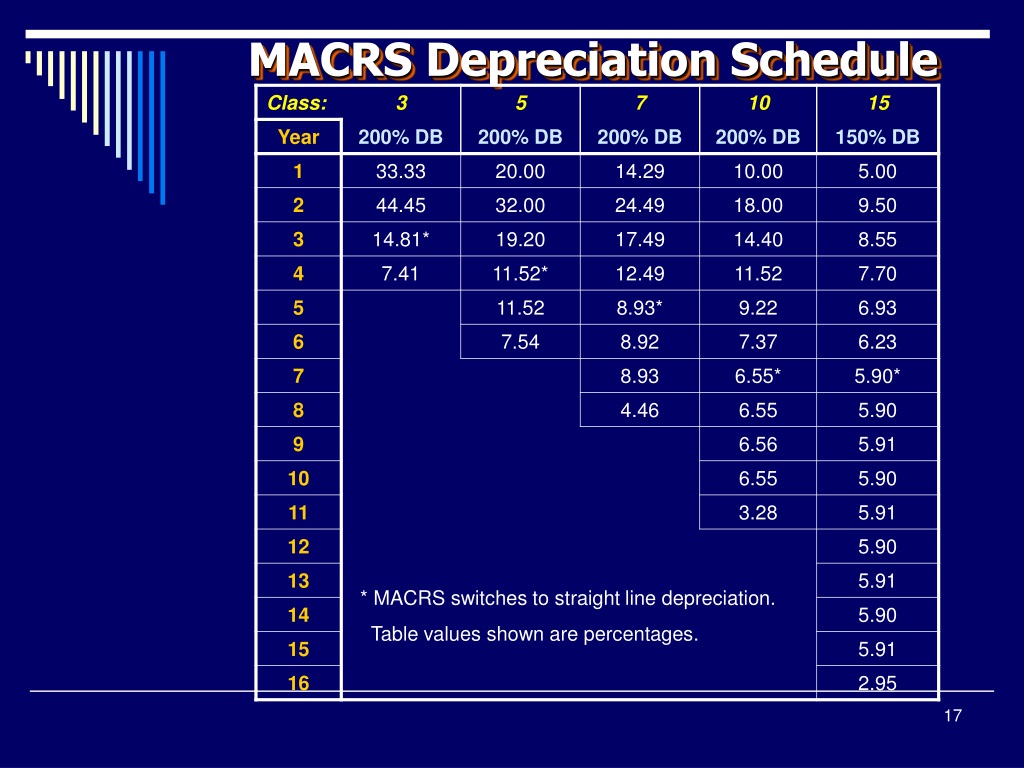

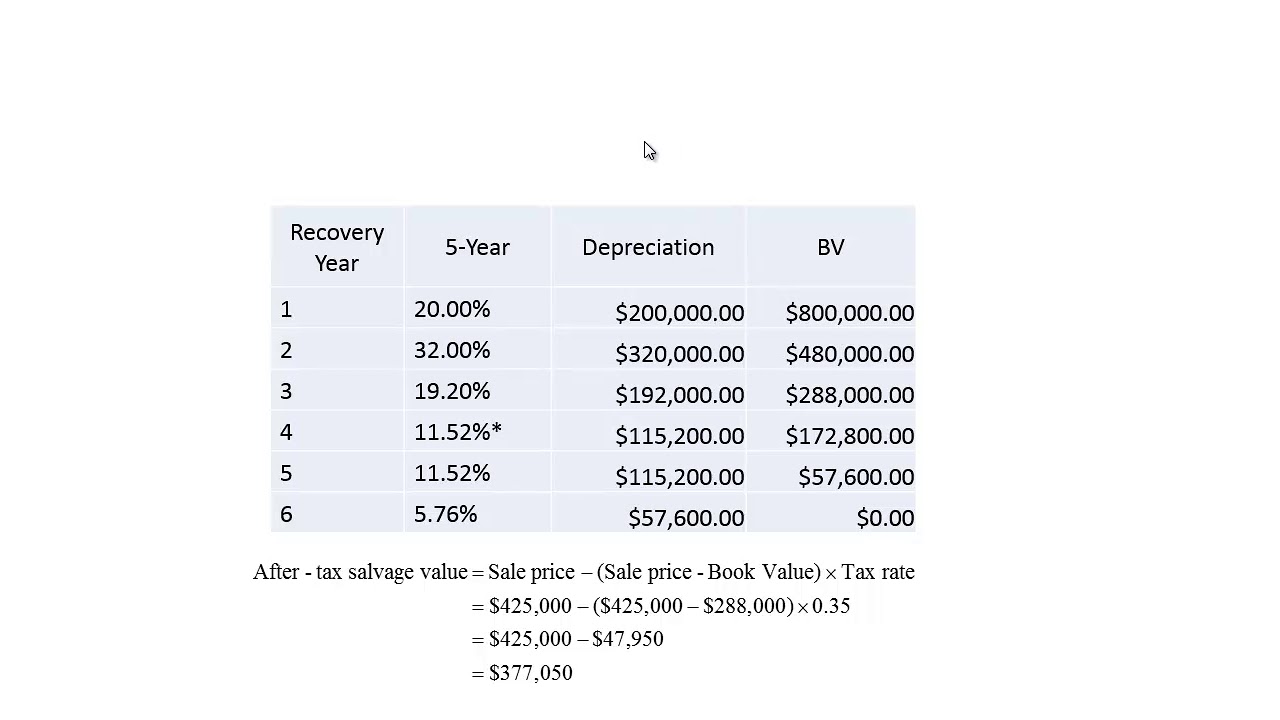

The MACRS depreciation schedule for the automated assembly line. Download Table

PPT Depreciation PowerPoint Presentation, free download ID9591902

Guide to the MACRS Depreciation Method Chamber Of Commerce

MACRS Depreciation Tables & How to Calculate

Macrs Depreciation Tables 39 Year Property Cycle Calculations

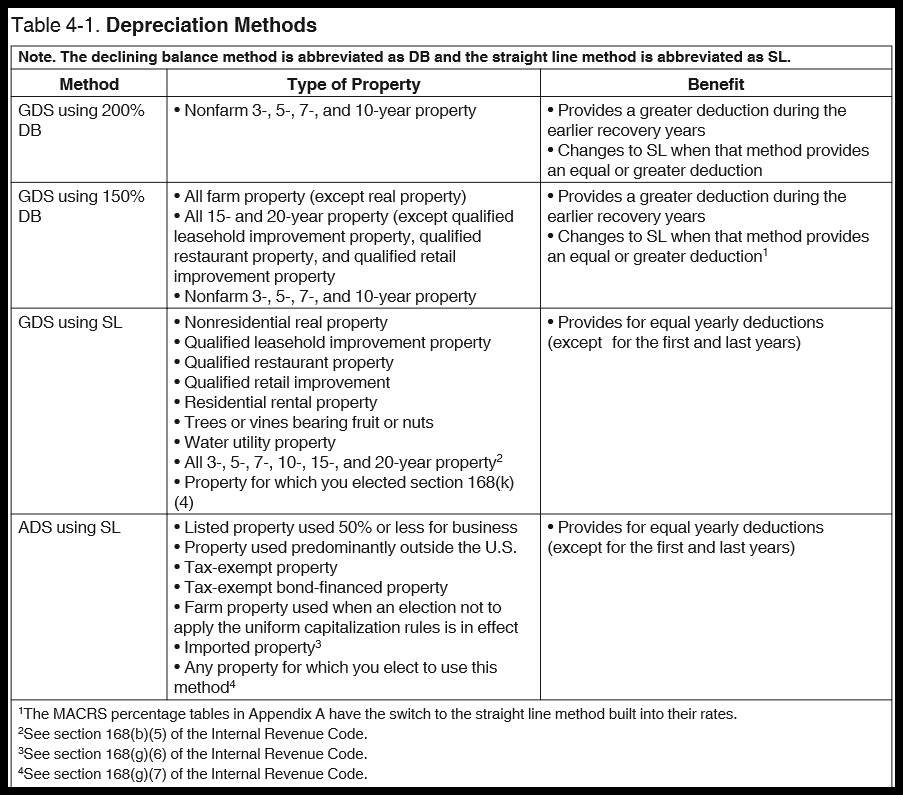

Method table

Macrs depreciation table 5 year 5 years, 10 years, 20 years

The Modified Accelerated Cost Recovery System (Macrs) Is The Current Tax Depreciation System In The United States.

The Macrs Depreciation Method Allows Greater Accelerated Depreciation Over The Life Of The Asset.

It Allows For A Higher Depreciation Deduction In The.

This Means That The Business Can Take Larger Tax Deductions In The Initial Years And.

Related Post: