Ira Rollover Chart

Ira Rollover Chart - Learn more about iras and. An individual retirement account (ira) is a retirement savings plan with tax advantages that taxpayers can use to invest over the long term for retirement. Traditional iras were introduced with the employee retirement income. Answer a few questions to find the right choice for you. Here are the key choices to make. Ira contribution calculator take the guesswork out of retirement planning. Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status. A traditional ira is a way to save for retirement that gives you tax advantages. Depending on the type of ira, contributions grow on either. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. Here are the key choices to make. Learn more about iras and. Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status. Depending on the type of ira, contributions grow on either. A traditional ira is a way to save for retirement that gives you tax advantages. Answer a few questions to find the right choice for you. An individual retirement account (ira) is a retirement savings plan with tax advantages that taxpayers can use to invest over the long term for retirement. Traditional iras were introduced with the employee retirement income. Ira contribution calculator take the guesswork out of retirement planning. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. Ira contribution calculator take the guesswork out of retirement planning. Depending on the type of ira, contributions grow on either. Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status. Traditional iras were introduced with the employee retirement income. Ira learn about an individual retirement account, including how to open an ira,. A traditional ira is a way to save for retirement that gives you tax advantages. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status. Answer a few questions to find. Here are the key choices to make. Ira contribution calculator take the guesswork out of retirement planning. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. An individual retirement account (ira) is a retirement savings plan with tax advantages that taxpayers can use to invest over the long. Traditional iras were introduced with the employee retirement income. Learn more about iras and. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. Depending on the type of ira, contributions grow on either. Here are the key choices to make. Learn more about iras and. Traditional iras were introduced with the employee retirement income. Ira contribution calculator take the guesswork out of retirement planning. Here are the key choices to make. Answer a few questions to find the right choice for you. Ira contribution calculator take the guesswork out of retirement planning. Learn more about iras and. An individual retirement account (ira) is a retirement savings plan with tax advantages that taxpayers can use to invest over the long term for retirement. Traditional iras were introduced with the employee retirement income. A traditional ira is a way to save for retirement that. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. Here are the key choices to make. Learn more about iras and. A traditional ira is a way to save for retirement that gives you tax advantages. Answer a few questions to find the right choice for you. Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status. Answer a few questions to find the right choice for you. Traditional iras were introduced with the employee retirement income. An individual retirement account (ira) is a retirement savings plan with tax advantages that taxpayers can use to invest over the long. Learn more about iras and. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. Here are the key choices to make. A traditional ira is a way to save for retirement that gives you tax advantages. Ira contribution calculator take the guesswork out of retirement planning. An individual retirement account (ira) is a retirement savings plan with tax advantages that taxpayers can use to invest over the long term for retirement. Learn more about iras and. Here are the key choices to make. Traditional iras were introduced with the employee retirement income. Answer a few questions to find the right choice for you. Depending on the type of ira, contributions grow on either. Ira learn about an individual retirement account, including how to open an ira, ira contribution limits, roth ira conversions, roth vs. A traditional ira is a way to save for retirement that gives you tax advantages. Answer a few questions to find the right choice for you. Contributions you make to a traditional ira may be fully or partially deductible, depending on your filing status. Here are the key choices to make. Traditional iras were introduced with the employee retirement income. Ira contribution calculator take the guesswork out of retirement planning.IRA Rollovers And Transfers Tim🍊 Acesse o BetNacional Oficial e bette com confiança

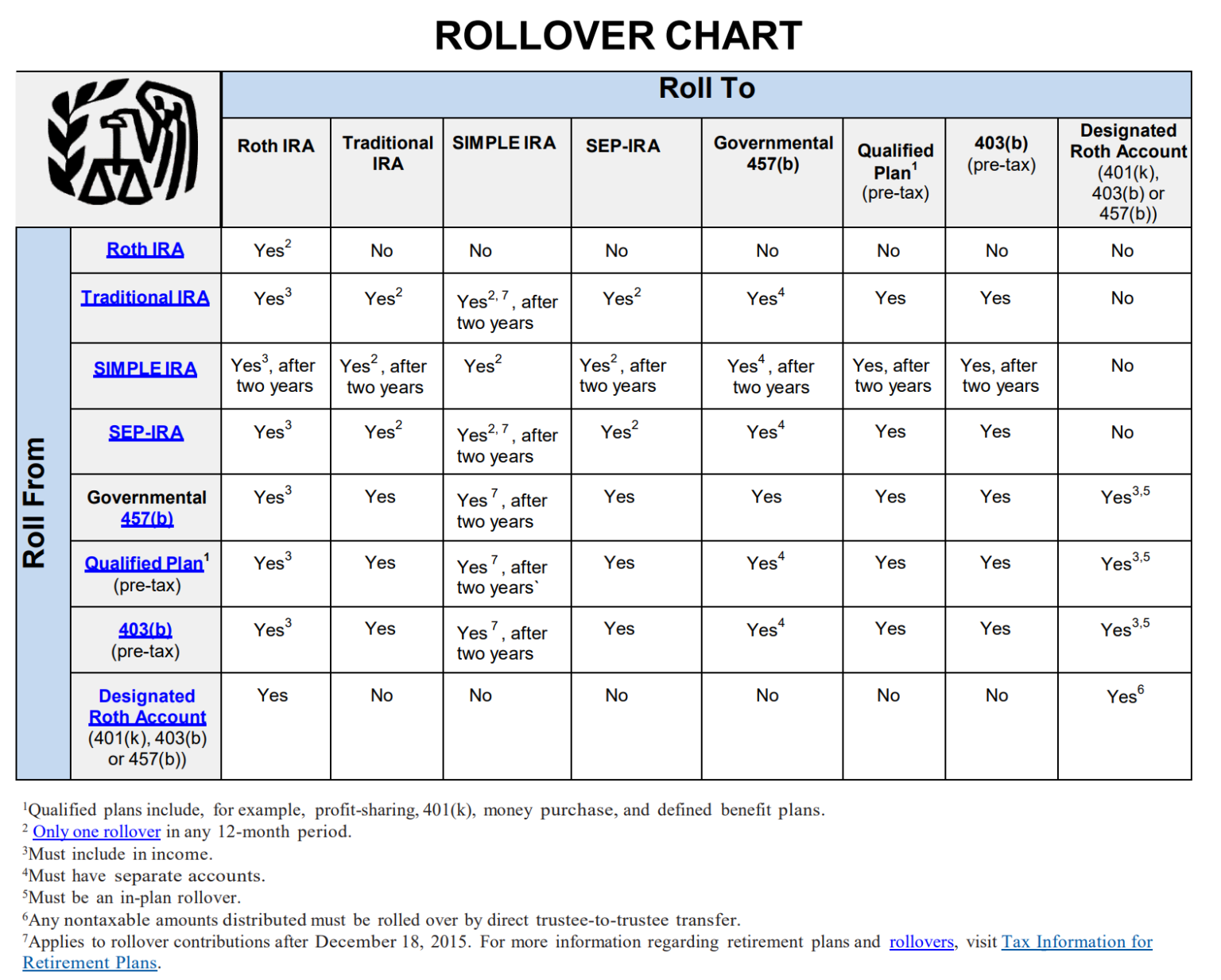

IRA rollovers and transfers Bogleheads

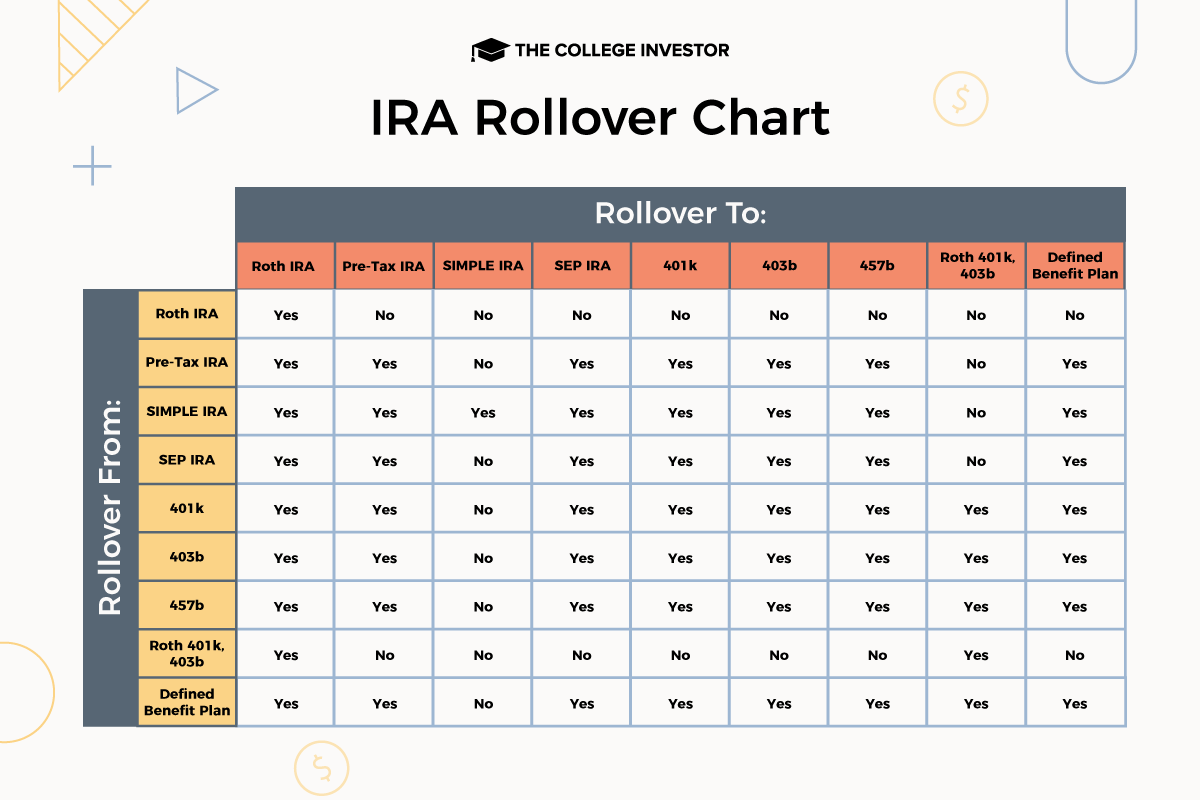

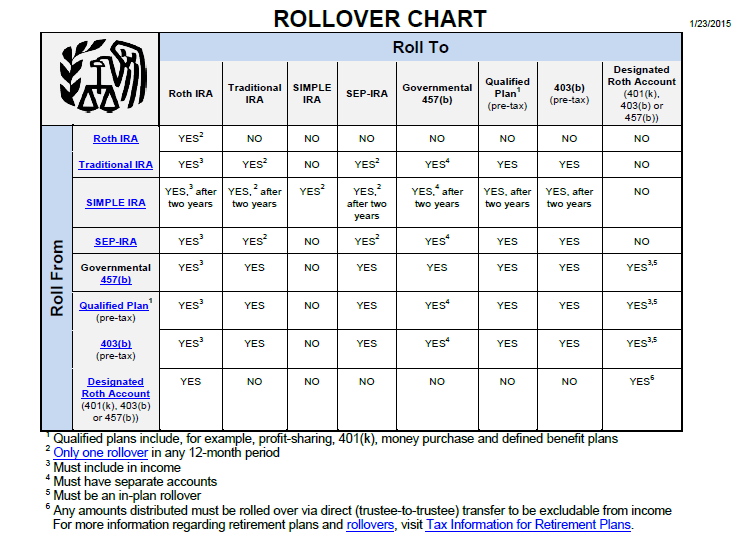

IRA Rollover Chart Where Can You Move Your Account?

Individual Retirement Accounts (IRAs) Prosperity Financial Group San Ramon, CA

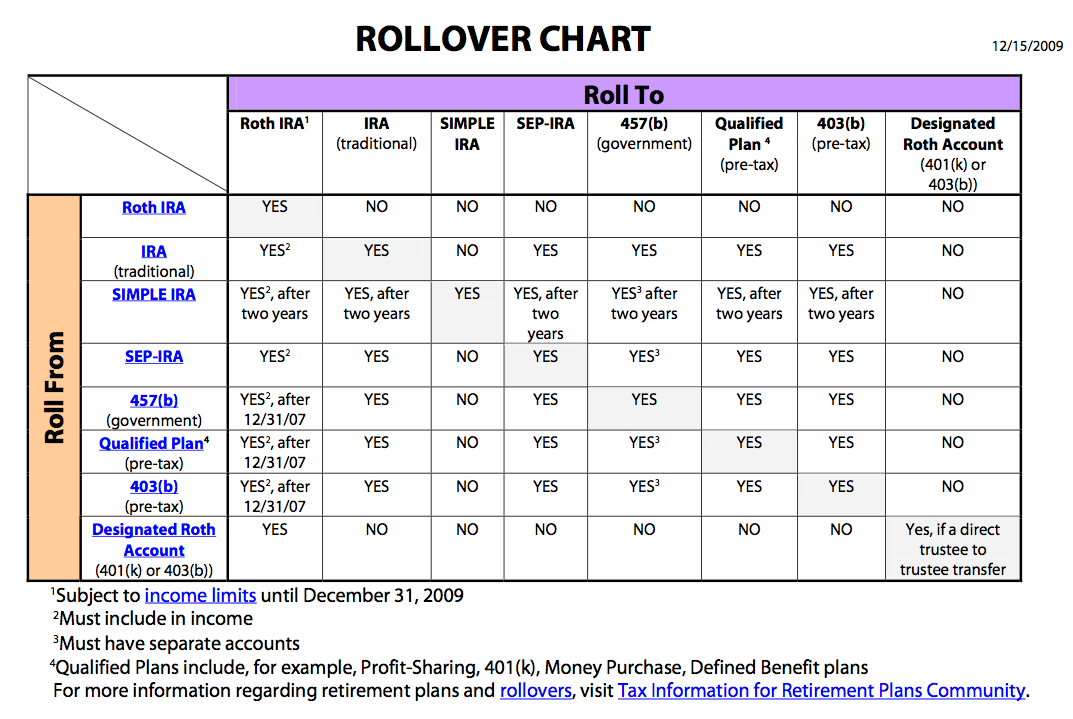

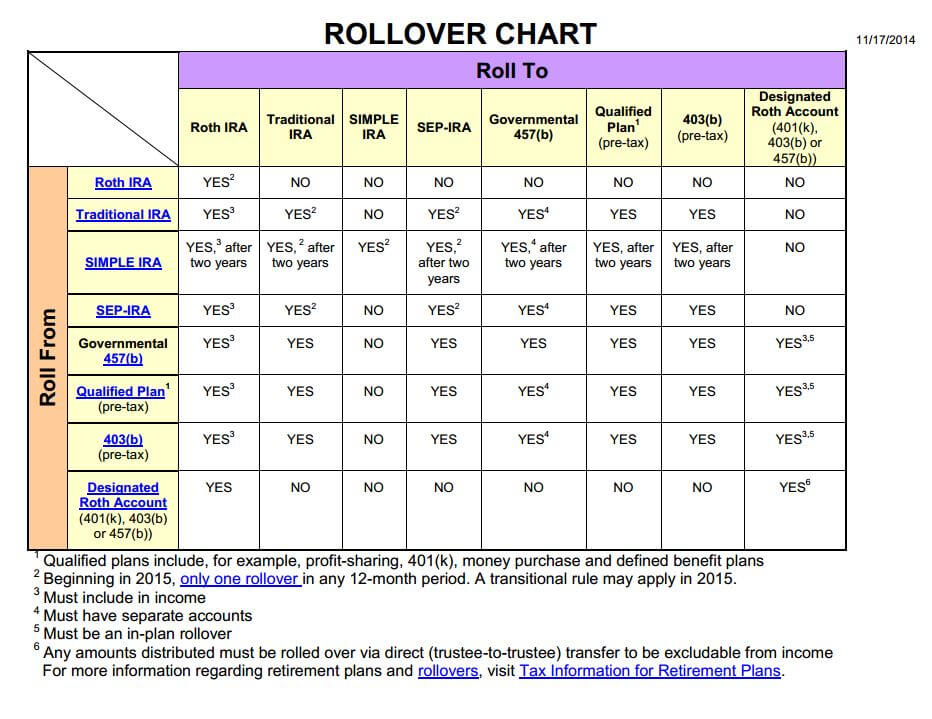

Rollover Rules Chart A Visual Reference of Charts Chart Master

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

Learn the Rules of IRA Rollover & Transfer of Funds

Learn the Rules of IRA Rollover & Transfer of Funds

IRA Rollovers Simple and GREAT chart from the IRS

Follow the Rules When Rolling Over Your EmployerSponsored Retirement Plan Rodgers & Associates

An Individual Retirement Account (Ira) Is A Retirement Savings Plan With Tax Advantages That Taxpayers Can Use To Invest Over The Long Term For Retirement.

Learn More About Iras And.

Related Post: