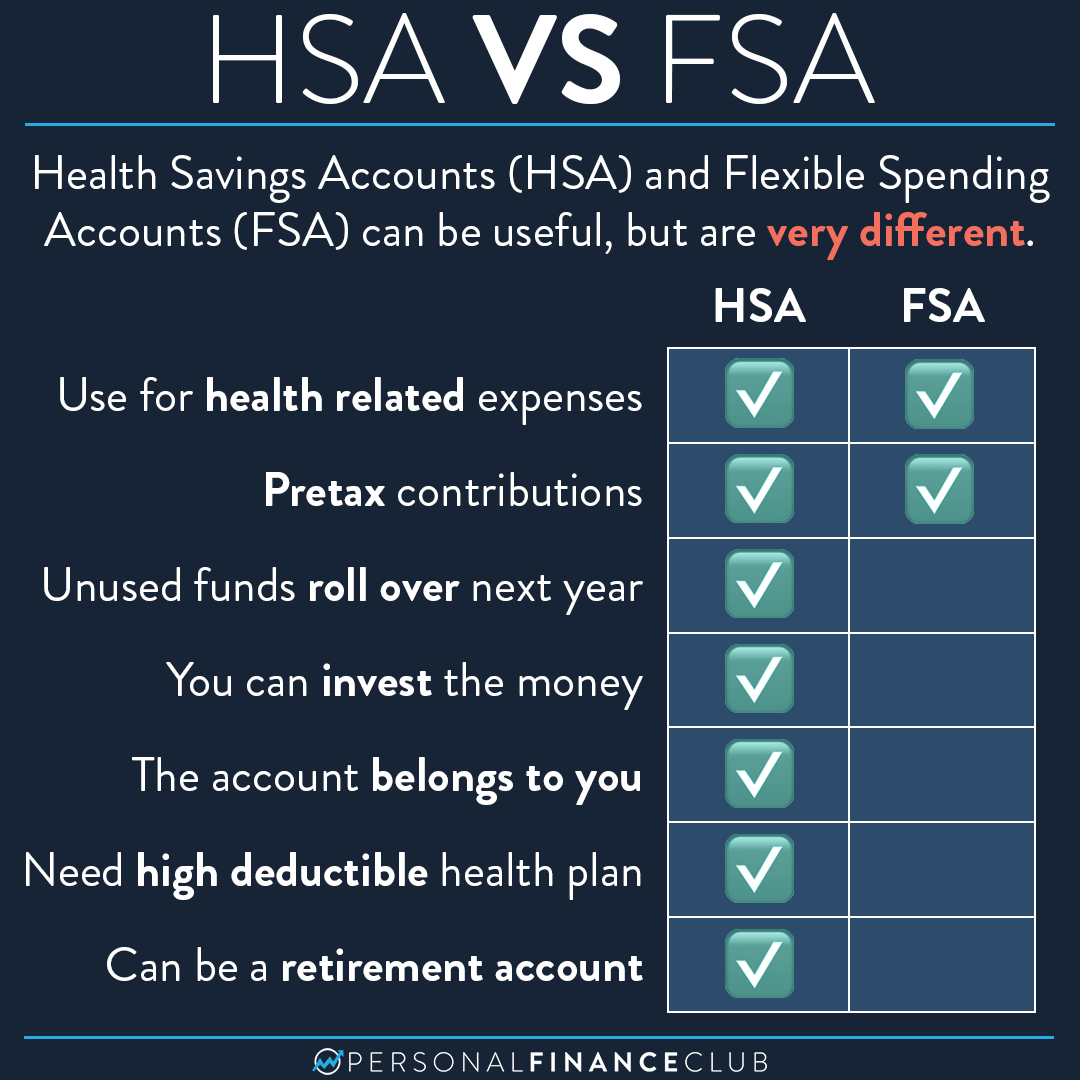

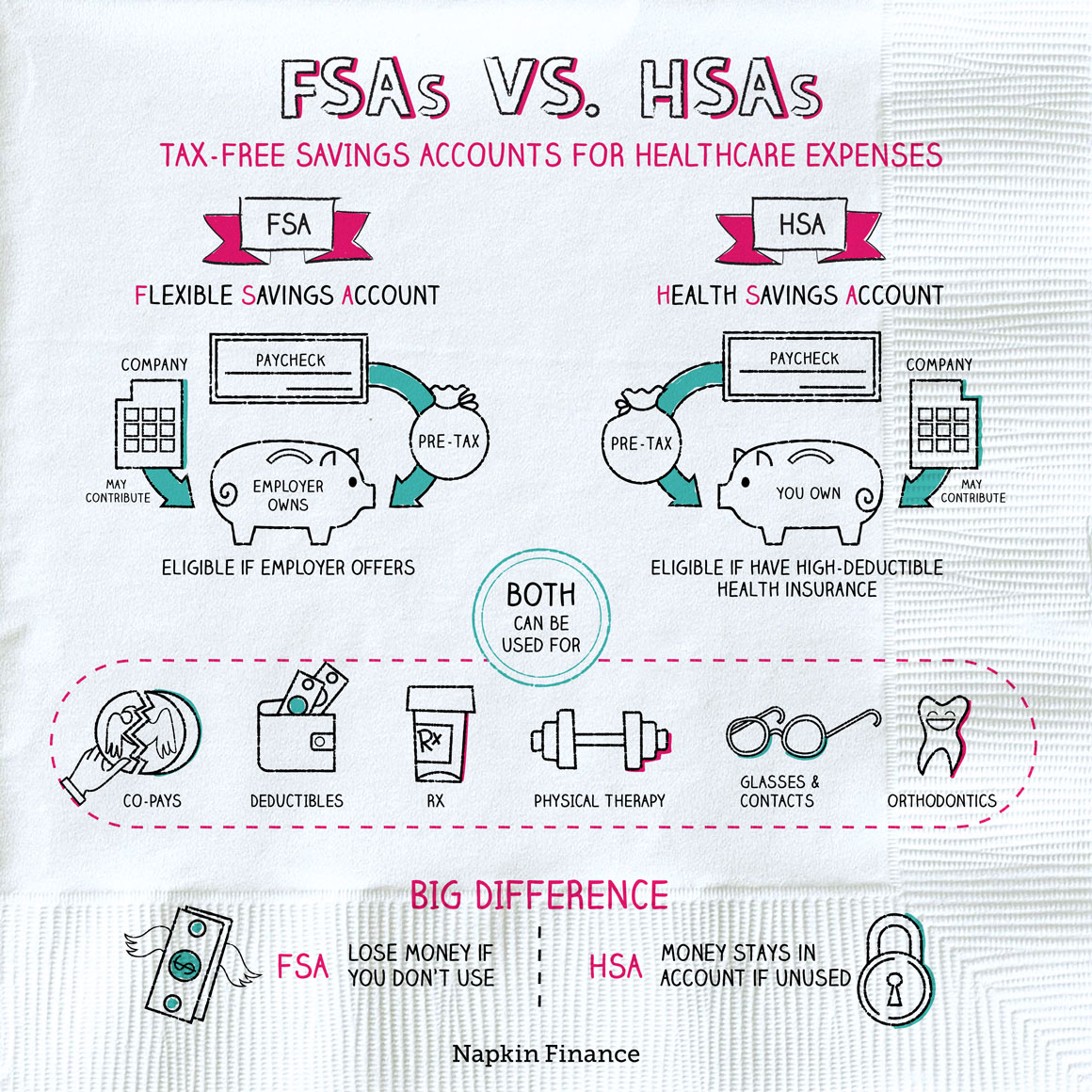

Hsa Vs Fsa Comparison Chart

Hsa Vs Fsa Comparison Chart - The following chart provides a. First, let’s look at how the three accounts are alike: These include medical care, prescription. Use this comparison chart to learn the differences between a health savings account (hsa) and a healthcare flexible spending account (fsa) to get the most out of your. Health savings accounts (hsas), flexible spending accounts (fsas), and health reimbursement arrangements (hras) are companion benefits employers can ofer to empower their. The choice of hsa vs. Compare and contrast hsas vs fsas. The following chart highlights the differences between an fsa vs hra vs hsa, broken down by account. Hsa, hra, and fsa benefit cards are automatically restricted for use with medical, dental and vision service providers and for items purchased at retail that are identified as qualified. Explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. Use this comparison chart to learn the differences between a health savings account (hsa) and a healthcare flexible spending account (fsa) to get the most out of your. If you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons we've outlined above. Health savings accounts (hsas), flexible spending accounts (fsas), and health reimbursement arrangements (hras) are companion benefits employers can ofer to empower their. The following chart highlights the differences between an fsa vs hra vs hsa, broken down by account. First, let’s look at how the three accounts are alike: Compare and contrast hsas vs fsas. Explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. The following chart provides a. These include medical care, prescription. Both hsas and fsas allow people to set aside money for health care costs referred to by the irs as qualified medical expenses. Health savings accounts (hsas), flexible spending accounts (fsas), and health reimbursement arrangements (hras) are companion benefits employers can ofer to empower their. Explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. The choice of hsa vs. Both hsas and fsas allow people to set aside money for health care costs. Both hsas and fsas allow people to set aside money for health care costs referred to by the irs as qualified medical expenses. Explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. The following chart provides a. The following chart highlights the differences between an fsa vs hra vs hsa,. The following chart provides a. Both hsas and fsas allow people to set aside money for health care costs referred to by the irs as qualified medical expenses. Hsa, hra, and fsa benefit cards are automatically restricted for use with medical, dental and vision service providers and for items purchased at retail that are identified as qualified. Explore their differences,. The health care flexible spending account (fsa) and the health savings account (hsa) provide tax savings on money put aside for eligible health expenses. Health savings accounts (hsas), flexible spending accounts (fsas), and health reimbursement arrangements (hras) are companion benefits employers can ofer to empower their. If you're eligible for both an hsa and fsa, be sure to carefully weigh. The following chart provides a. The choice of hsa vs. Use this comparison chart to learn the differences between a health savings account (hsa) and a healthcare flexible spending account (fsa) to get the most out of your. If you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons we've. Health savings accounts (hsas), flexible spending accounts (fsas), and health reimbursement arrangements (hras) are companion benefits employers can ofer to empower their. First, let’s look at how the three accounts are alike: Both hsas and fsas allow people to set aside money for health care costs referred to by the irs as qualified medical expenses. If you're eligible for both. These include medical care, prescription. Use this comparison chart to learn the differences between a health savings account (hsa) and a healthcare flexible spending account (fsa) to get the most out of your. Compare and contrast hsas vs fsas. Both hsas and fsas allow people to set aside money for health care costs referred to by the irs as qualified. These include medical care, prescription. The choice of hsa vs. Use this comparison chart to learn the differences between a health savings account (hsa) and a healthcare flexible spending account (fsa) to get the most out of your. First, let’s look at how the three accounts are alike: Hsa, hra, and fsa benefit cards are automatically restricted for use with. These include medical care, prescription. If you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons we've outlined above. The following chart provides a. The health care flexible spending account (fsa) and the health savings account (hsa) provide tax savings on money put aside for eligible health expenses. Hsa, hra,. First, let’s look at how the three accounts are alike: Hsa, hra, and fsa benefit cards are automatically restricted for use with medical, dental and vision service providers and for items purchased at retail that are identified as qualified. If you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons. Hsa, hra, and fsa benefit cards are automatically restricted for use with medical, dental and vision service providers and for items purchased at retail that are identified as qualified. Use this comparison chart to learn the differences between a health savings account (hsa) and a healthcare flexible spending account (fsa) to get the most out of your. If you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons we've outlined above. Both hsas and fsas allow people to set aside money for health care costs referred to by the irs as qualified medical expenses. Health savings accounts (hsas), flexible spending accounts (fsas), and health reimbursement arrangements (hras) are companion benefits employers can ofer to empower their. Compare and contrast hsas vs fsas. These include medical care, prescription. Explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. The choice of hsa vs. The following chart provides a.Flex What Are HSAs and FSAs? A Comprehensive Guide

Health Savings Account Vs Health Care Spending Account Healthy Living Maintain

HSAs vs FSAs What's the Difference? Aeroflow Health

HSA vs. FSA Understanding the Differences • 7ESL

FSA vs HSA What’s the Difference and Importance?

HSA vs. FSA The Ultimate Guide for Federal Employees

How is an HSA different from an FSA? Personal Finance Club

FSA vs HSA Use it or lose it Napkin Finance

What’s the Difference Between an HSA, FSA, and HRA? Hsa, Fsa, Financial goals

HSA VS FSA Save Money On Healthcare {Useful Guide}

The Health Care Flexible Spending Account (Fsa) And The Health Savings Account (Hsa) Provide Tax Savings On Money Put Aside For Eligible Health Expenses.

The Following Chart Highlights The Differences Between An Fsa Vs Hra Vs Hsa, Broken Down By Account.

First, Let’s Look At How The Three Accounts Are Alike:

Related Post: