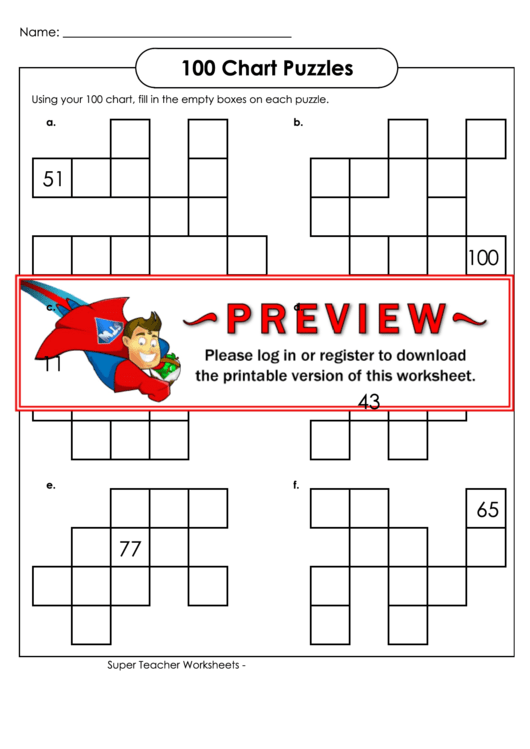

100S Chart Puzzle

100S Chart Puzzle - Verification confirms that all assets on the balance sheet truly exist and are correctly valued. Asset verification is a systematic process that validates the physical presence, condition, location, and ownership of an organization's physical assets. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. Learn how to do fixed asset verification with our guide. On the report form balance sheet, the liabilities and owner's equity are listed to the right of the assets. Ias 16 and ias 38 present two options for measuring pp&e or intangible assets after their initial recognition: On the account form, the liabilities and owner's equity are listed under the assets. The cost model or the revaluation model (ias 16.29; I t’s simply a matter of creating a spreadsheet that lists all accounts on your balance sheet, their values in gl, their values from the validating reports and then a column calculating any. This prevents overstatement or understatement of asset balances. The cost model or the revaluation model (ias 16.29; Verification confirms that all assets on the balance sheet truly exist and are correctly valued. On the account form, the liabilities and owner's equity are listed under the assets. I t’s simply a matter of creating a spreadsheet that lists all accounts on your balance sheet, their values in gl, their values from the validating reports and then a column calculating any. Ias 16 and ias 38 present two options for measuring pp&e or intangible assets after their initial recognition: Learn how to do fixed asset verification with our guide. This prevents overstatement or understatement of asset balances. Asset verification is a systematic process that validates the physical presence, condition, location, and ownership of an organization's physical assets. From planning & physical inspection to reconciliation & reporting, ensuring accuracy. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. On the report form balance sheet, the liabilities and owner's equity are listed to the right of the assets. I t’s simply a matter of creating a spreadsheet that lists all accounts on your. From planning & physical inspection to reconciliation & reporting, ensuring accuracy. I t’s simply a matter of creating a spreadsheet that lists all accounts on your balance sheet, their values in gl, their values from the validating reports and then a column calculating any. Ias 16 and ias 38 present two options for measuring pp&e or intangible assets after their. Learn how to do fixed asset verification with our guide. From planning & physical inspection to reconciliation & reporting, ensuring accuracy. The cost model or the revaluation model (ias 16.29; I t’s simply a matter of creating a spreadsheet that lists all accounts on your balance sheet, their values in gl, their values from the validating reports and then a. From planning & physical inspection to reconciliation & reporting, ensuring accuracy. I t’s simply a matter of creating a spreadsheet that lists all accounts on your balance sheet, their values in gl, their values from the validating reports and then a column calculating any. Learn how to do fixed asset verification with our guide. On the account form, the liabilities. The cost model or the revaluation model (ias 16.29; The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. On the report form balance sheet, the liabilities and owner's equity are listed to the right of the assets. Asset verification is a systematic process. This prevents overstatement or understatement of asset balances. Ias 16 and ias 38 present two options for measuring pp&e or intangible assets after their initial recognition: On the account form, the liabilities and owner's equity are listed under the assets. Verification confirms that all assets on the balance sheet truly exist and are correctly valued. The company can calculate the. Learn how to do fixed asset verification with our guide. This prevents overstatement or understatement of asset balances. Asset verification is a systematic process that validates the physical presence, condition, location, and ownership of an organization's physical assets. On the report form balance sheet, the liabilities and owner's equity are listed to the right of the assets. On the account. Asset verification is a systematic process that validates the physical presence, condition, location, and ownership of an organization's physical assets. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. On the account form, the liabilities and owner's equity are listed under the assets.. Asset verification is a systematic process that validates the physical presence, condition, location, and ownership of an organization's physical assets. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. On the account form, the liabilities and owner's equity are listed under the assets.. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the. On the account form, the liabilities and owner's equity are listed under the assets. The cost model or the revaluation model (ias 16.29; Learn how to do fixed asset verification with our guide. On. On the report form balance sheet, the liabilities and owner's equity are listed to the right of the assets. Learn how to do fixed asset verification with our guide. The cost model or the revaluation model (ias 16.29; From planning & physical inspection to reconciliation & reporting, ensuring accuracy. On the account form, the liabilities and owner's equity are listed under the assets. Asset verification is a systematic process that validates the physical presence, condition, location, and ownership of an organization's physical assets. I t’s simply a matter of creating a spreadsheet that lists all accounts on your balance sheet, their values in gl, their values from the validating reports and then a column calculating any. Verification confirms that all assets on the balance sheet truly exist and are correctly valued.Number Puzzles Ordering Numbers on a 100s Chart Mathful Learners

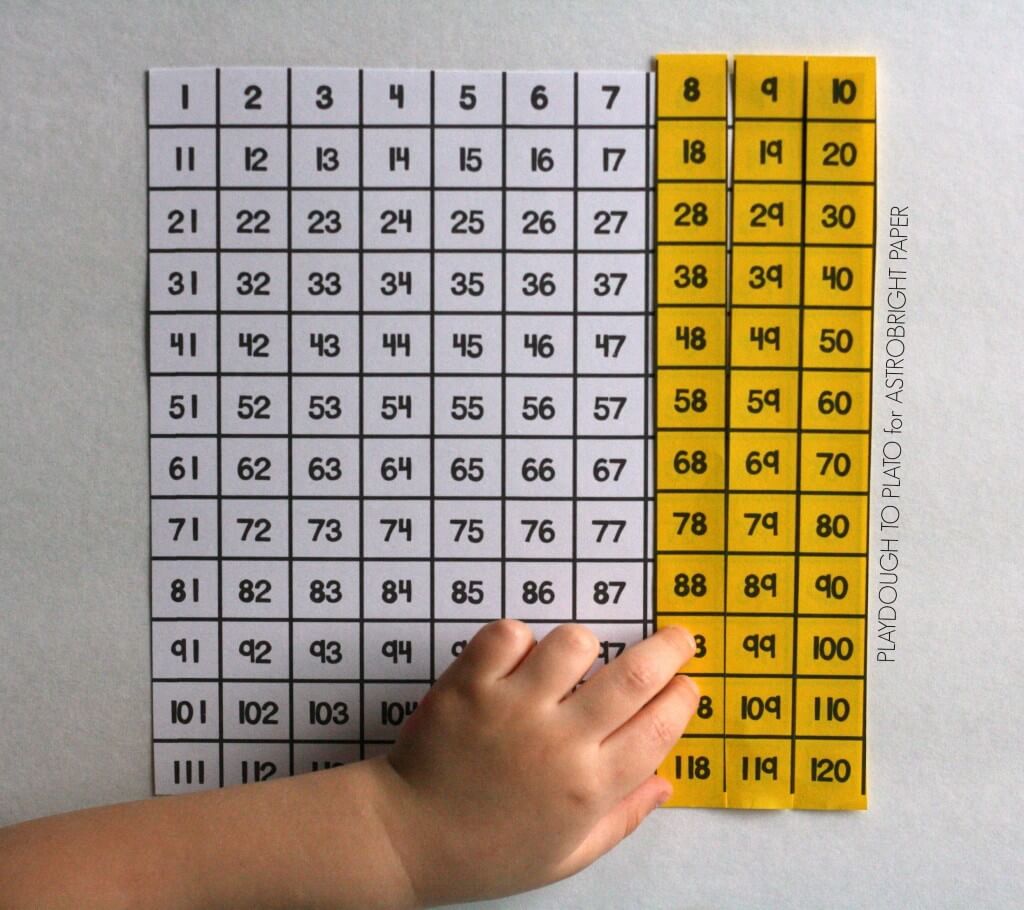

Hundred Chart Puzzle with Printable Teach Beside Me

Hundred Chart Puzzle with Printable Teach Beside Me

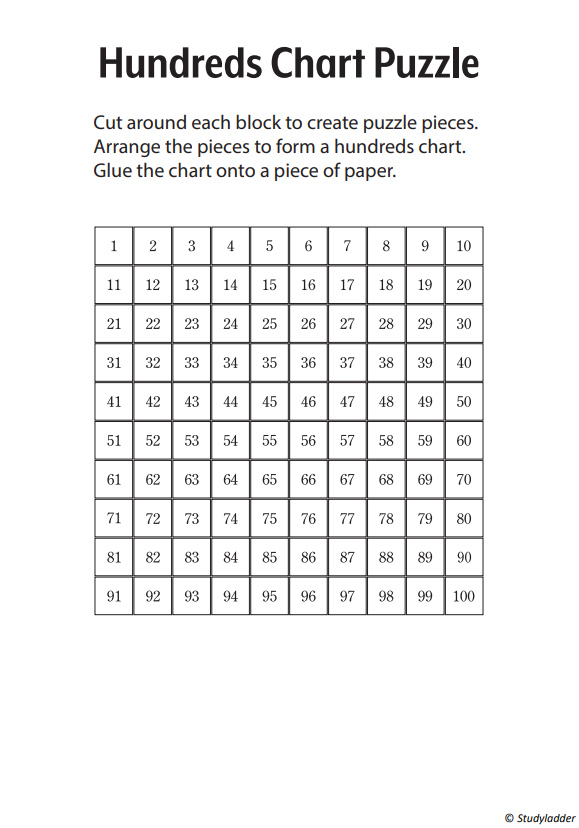

Hundreds Chart Puzzle 3 printable pdf download

Free Hundreds Chart Puzzles for Kids

Hundred Chart Puzzles Colorize Playdough To Plato

Hundred Chart Puzzle with Printable Teach Beside Me

Hundreds Chart puzzle Studyladder Interactive Learning Games

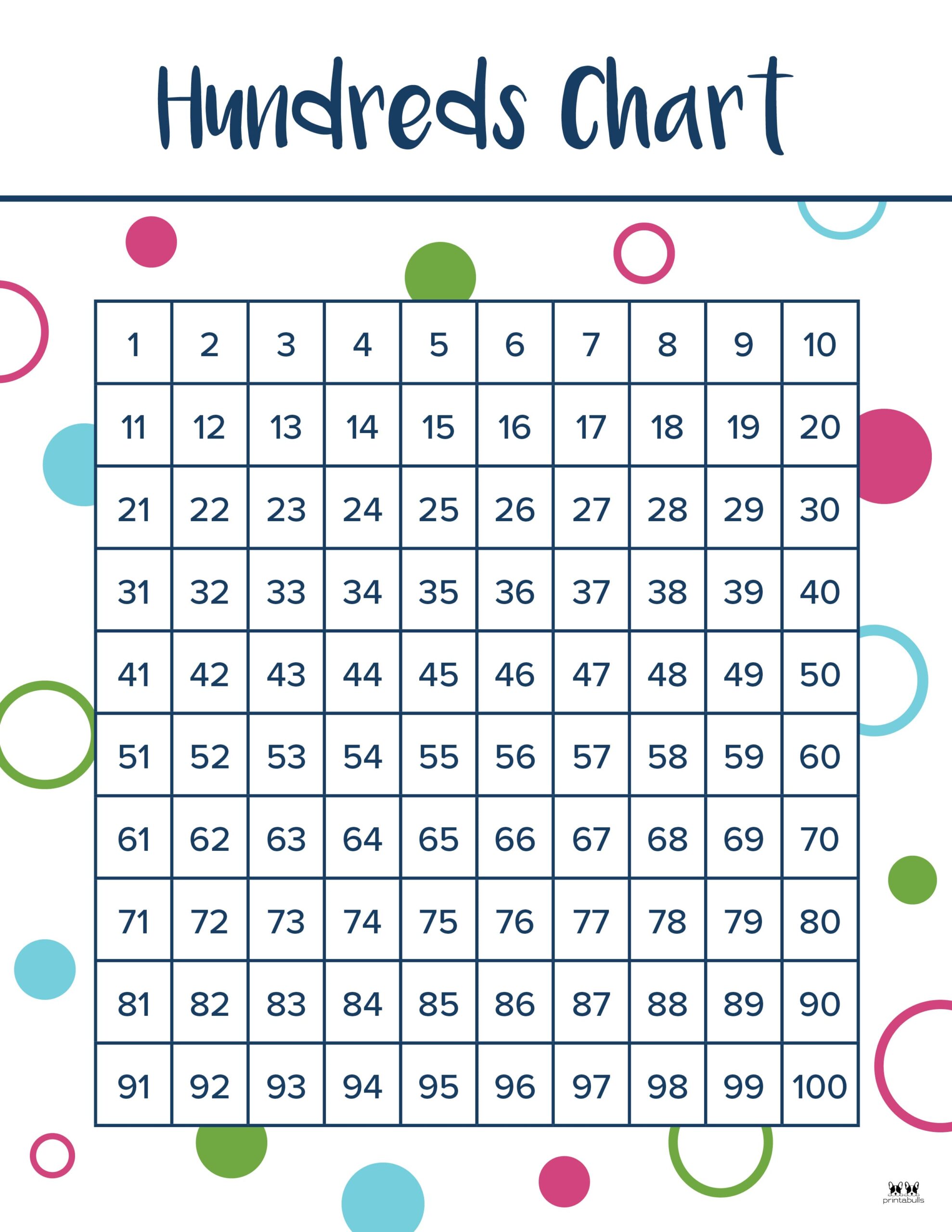

Hundreds Charts 25 FREE Printables Printabulls

Free Hundreds Chart Puzzles

The Company Can Calculate The Revised Depreciation By Determining The Remaining Depreciable Cost With The Formula Of Deducting The Accumulated Depreciation And Salvage Value At The.

Ias 16 And Ias 38 Present Two Options For Measuring Pp&E Or Intangible Assets After Their Initial Recognition:

This Prevents Overstatement Or Understatement Of Asset Balances.

Related Post: